Tax Free Millionaire Summit

Slash Your Tax Bill by Up to 100% in Just 3 Days

Tax Alchemy

Get Ready To Join The

Tax Free Millionaire Summit

In 3 days, I will show you how to cut your entire tax bill by 50-100%... Even if you are brand-new to tax strategy.

3,000+ people have used our tax strategies to cut their tax bill in half or eliminate it entirely. Some even receive refund checks from the IRS after getting their tax bills down to $0! Now it’s your turn.

JOIN THE Tax Free Millionaire Summit AND IN JUST 3 DAYS:

You'll Learn Exactly How To Dramatically Reduce Your Tax Bill So That You Pay Just A Fraction of What You're Currently Paying.

(We walk you through all of the key concepts and strategies, step-by-step)

October 21-23, 2025 | 5PM PST | Virtual Live Event

Regular Ends Soon - Lock In Your Spot

Regular Pricing Expires in:

Early Bird

200 Seats

$47

With Access To The Tax Free Millionaire Community

Regular

201-600 Seats

$97

With Access To The Tax Free Millionaire Community

Late

601-1,000 Seats

$147

Without Access To The Tax Free Millionaire Community

Last Minute

1,001-2,000 Seats

$197

Without Access To The Tax Free Millionaire Community

From Karlton Dennis:

To all the high earners out there facing massive 6 or 7-figure tax bills - what I am about to show you will completely transform the way you approach your taxes.

I have helped thousands of people go from paying a fortune in taxes every year to saving a fortune.

I am going to show YOU too.

But first, you need to understand where I started.

Right out of college, I took a W-2 job as a salesman at a wine company. Although I was happy with the steady paycheck, I became increasingly frustrated at the massive amount of my income that was being spent on taxes.

I felt like I was working incredibly hard only to have to fork over a huge amount of money to the government.

But I didn’t believe him. I knew that there were billionaires out there like Jeff Bezos and Elon Musk who barely pay any taxes.

So, I started looking into tax strategy. I also left the wine company and started working as a salesman for my mother’s tax firm.

Additionally, I pursued a certification as an “enrolled agent,” which is the highest tax credential offered by the IRS.

By working at my mother’s firm and becoming an enrolled agent, I learned hundreds of different high-ticket tax strategies - I’m talking about the ones that the top 1 percent wealthiest people in the country use year-in and year-out to wipe out their tax bills.

These strategies allow you to…

1. Dramatically Reduce Your Taxable Income.

2. Write off Almost Anything.

3. Leverage Powerful Deductions Like Depreciation.

4. Shift Your Income Between Entities to Optimize Tax Benefits.

5. Add Your Children or Your Spouse to Payroll for Tax Advantages … and much more

You see, most people are completely unaware of these strategies. This is because they either don’t take the time to learn them, or because they mistakenly assume that their CPA is doing everything possible to reduce their tax burden.

Tax Accounting vs. Tax Strategy

The truth is, most CPAs simply do not put a lot of effort into lowering your tax bill. Instead, they are primarily concerned with tax accounting as opposed to tax strategy.

Tax accounting is the process of completing and filing tax returns accurately. - CPAs care very much about accuracy. In fact, they are trained to prioritize it as opposed to tax reduction.

Tax strategy on the other hand is the process of reducing your tax liability as much as possible by taking advantage of deductions, credits, income timing, entity structuring, and more.

Enrolled agents primarily focus on tax strategy.

So, right off the bat, if you are not already working with an enrolled agent, you are missing out on an incredible opportunity to save a fortune in taxes.

When I became an enrolled agent, I learned that in the 6,000+ page tax code, the government actually has many different rules that allow you to legally reduce your tax burden.

The key is knowing how to implement the right tax strategies to leverage the critical tax rules to maximize your tax savings.

Once I learned how to do this, I was able to reduce my own tax bill by 80-100 percent every single year!

I built my own tax firm, Tax Alchemy, to teach thousands of other people how to do the exact same thing, and guess what, now, it’s YOUR turn.

You Have To Make A Choice

You can either:

A. Keep doing what you’re doing and keep paying 30-50% of your hard-earned money to the government every year.

Or…

B. Learn how to leverage the tax code to the fullest extent through advanced tax strategy to cut your tax bill by 50-100% per year.

A.C. Mata Chose Option B and he literally saved HUNDREDS OF THOUSANDS OF DOLLARS in taxes.

Every dollar you save in taxes is another dollar you can spend…

Growing your business

Taking vacations

Expanding your retirement accounts

Buying houses

Paying for weddings

Investing in stocks

Taking care of your family

Buying things you care about

Paying off debt

… and more

The fact is - life is simply better when you get to keep more of your hard-earned money.

I mean, why work for 3-6 months out of the year just to give it all to the government when you can just learn tax strategy and keep that money instead??

My company has now generated HUNDREDS OF MILLIONS OF DOLLARS in tax savings for our clients.

Our methods have worked for thousands of people, and they will work for you too.

YOU DON’T NEED TO…

Be a tax expert

Have any experience with tax strategy

Have worked with a CPA for many years

Know how to file taxes yourself

The strategies I will teach you during the 3-day webinar can work for you whether you are brand-new to tax strategy, or whether you are highly experienced with saving money in taxes.

The Best-Kept Tax Secret

Here’s something most people don’t know. - When it comes to taxes, the best way to save money is actually to spend money.

Let me explain.

The IRS gives enormous tax breaks to people who invest in specific assets like real estate, oil wells, gas wells, businesses, and more.

You may have heard that real estate investors are eligible for great tax breaks. This isn’t just a rumor. It’s actually 100 percent true.

Here’s how it works. If you’re a high earner, you can either pay the IRS a large tax bill and get little to nothing back. Or, you can invest the money you would have spent on taxes buying a tax-advantaged asset.

A tax-advantaged asset is an asset that the government gives powerful tax breaks for.

You see, the government taxes cash you earn heavily, but it is extremely lenient when it comes to specific investments.

This is because the nation benefits when you buy certain assets. - For example, If you buy rental real estate, you are helping to provide housing. If you buy oil or gas wells, you are helping to provide energy, etc.

So, when you buy assets that help the country, the government sees you as a team player, and it rewards you by lowering your taxes or even completely eliminating them in some cases.

Therefore, the goal is to transfer a significant amount of your earned income to tax-advantaged assets. When you do this, you can get a valuable asset that can cash flow for many years while dramatically reducing your tax bill at the same time. Win/win.

We can take advantage of tax-advantaged assets to build wealth while dramatically reducing taxes. The wealthiest people in the country are well aware of this and do it on a regular basis. That is why they are able to stay in the lowest tax brackets while making the most money.

During the summit, I will teach you exactly how to invest in tax-advantaged assets correctly to cut your tax bill by 50-100%. This can be an absolute game-changer for your tax situation.

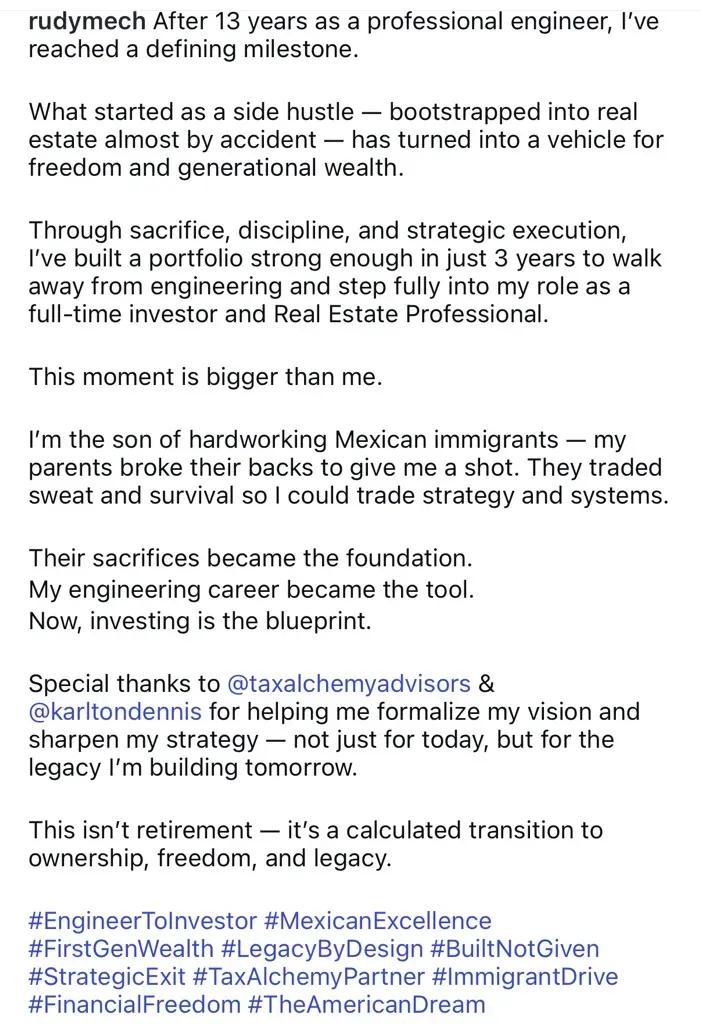

The Conversations Happening In Rooms You're Not In... Yet

See what Tax Alchemy clients are celebrating in our exclusive community.

Who Is This Summit For?

This summit is for you if…

You’re a business owner making $500k+ per year

You’re a W-2 earner making $400k+ per year

Your CPA is not saving you enough money in taxes

Your CPA takes too long to respond to you

You are paying 30%, 40%, or 50%+ of what you earn to Uncle Sam

You feel sick every time you write a massive check to the IRS

You want to know how billionaires pay lower tax rates than people making $50k

You would rather spend money on your family than give it to the IRS

You don’t want taxes to be your largest annual expense for the rest of your life

You want to set your family up to build and protect generational wealth

Tax Free Millionaire Summit Agenda

The summit takes place over three days from October 21-23, 2025. Karlton answers your questions live each day before the training begins.

Day 1. The Tax Strategy Framework

Master the Millionaire Mindset + Advanced Entity Structuring

Discover the winning mindset that lets the top 1% stay confident, never fear the IRS, and make bold tax moves that get massive results.

The Millionaire Tax Mindset - How wealthy Americans think about taxes differently than everyone else

IRS Tax System Navigation - How to move between different tax systems within the Internal Revenue Code to slash what you owe

8-Figure Write-Off Secrets - Real examples from millionaires that will completely shift your perspective on what's possible

Advanced Entity Optimization:

LLC vs. S Corp vs. C Corp advantages for different income levels

LLC layering techniques that lower taxes while enhancing asset protection

Strategic entity conversions (LLC to S Corp timing for maximum savings)

Liability separation methods that protect assets and amplify privacy

Bottom Line: You'll build the foundation for tax-free wealth and understand exactly how the wealthy legally pay little to nothing.

Day 2. Advanced Real Estate and Income-Shifting Strategies

Turn Real Estate Into Your Ultimate Tax-Saving Machine

Learn how to offset W-2 and 1099 income using real estate strategies, even if you're not a full-time real estate professional.

Short-Term Rental Loophole - Offset your entire salary with rental losses (legally!)

Self-Rental Strategy - Underutilized method that creates massive deductions while keeping full control

Complete Cost Segregation Training:

Accelerate depreciation to front-load deductions

Put more cash in your pocket faster through strategic timing

Turn real estate into a tax-eliminating machine

Advanced Income-Shifting Strategies:

Legally shift taxable income across multiple entities

Corporate management company setup for streamlined operations

Augusta Rule implementation - Pay yourself tax-free by renting your home to your business

Holding company structures for bulletproof asset protection

Bottom Line: Transform real estate from an investment into your primary tax elimination tool with strategies used by top entrepreneurs.

Day 3. Alternative Investments to Wipe Out Your Tax Bill

Eliminate 50-100% of Your Taxes Through Smart Investments

This is where it all comes together! Leverage alternative investments to generate massive tax savings and potentially eliminate your entire tax bill.

Tax-Eliminating Investment Strategies:

Film financing opportunities (IRC 181) for entertainment tax credits

Energy investment programs with immediate write-offs

Equipment and asset purchases with Section 179 and bonus depreciation

Alternative investment structures that maximize deductions while building wealth

Strategic Implementation:

Investment timing considerations for maximum tax benefit

Structure optimization to legally lower taxes by 50-100%

Wealth-building integration - Grow assets while eliminating taxes

Long-term planning for sustained tax advantages

Complete Tax Strategy Integration:

How all three days work together for maximum savings

Actionable implementation roadmap for immediate results

Professional coordination to execute your complete plan

Bottom Line: Walk away with the complete blueprint to protect your income, increase cash flow, and maximize tax savings like the ultra-wealthy.

What Separates 6-Figure Earners From 6-Figure Savers

Spoiler alert: It's not about making more money. It's about keeping more money.

What You Will Walk Away With:

Actionable strategies to cut your tax bill by 50-100%

A better understanding of how the top 1 percent pay little to no tax

Clarity about why a CPA alone, is usually not enough

Guidance on how to set up your entities to cut taxes, hire your family members correctly, and optimize anonymity

Techniques for making the best possible tax-advantaged investments to dramatically reduce tax

A grasp of how to use investment losses to offset your W-2 or 1099 income

A roadmap for using tax strategy to set your family up for generational wealth ... and much more

These Clients Asked The Same Questions You Did

"Is this too good to be true?" "Will this work for my situation?" Here are their answers.

Your Host for the Summit

My name is Karlton Dennis, I am an Enrolled Agent licensed in all 50 states. I am the Founder and CEO of Tax Alchemy, one of the fastest-growing tax strategy firms in the nation. Additionally, I own the “Karlton Dennis” YouTube channel, which is one of the largest tax channels on the platform. This channel currently has over 1 million subscribers. I am also a Forbes Business Council Member, a real estate investor with 17+ properties, and an author of multiple books on tax strategy.

Through my YouTube channel, social media platforms, and published books, I’ve taught tax strategy to tens of millions of people. At my firm, Tax Alchemy, we take that education a step further by working directly with thousands of clients to reduce their tax liabilities by 50 to 100%. We’ve saved our clients hundreds of millions of dollars in taxes collectively.

My goal is to demystify the 6000+ page tax code to help people keep more of their hard-earned money. The more money you keep, the better you can take care of your family and your other loved ones. I cannot wait to teach you game-changing tax strategies that will transform your finances for the better and give you your power back.

Looking forward to seeing you inside the summit!

Building Generational Wealth

Tax strategy not only helps you to save money in taxes in the short term, it also is a key component for building generational wealth.

This is because, when you can keep a higher percentage of your income, you can more effectively grow your net worth over time. When you make money, whether through a job, investments, or running a business, taxes can take a significant chunk if you’re not careful.

By using smart, legal tax planning, you can reduce what you owe and reinvest those savings into assets like real estate, stocks, or retirement accounts that increase in value. Over time, this can dramatically boost your net worth.

Just as importantly, effective tax strategies can help you pass more of that wealth on to your children or grandchildren. Without planning, your heirs might face heavy taxes that eat into what you leave behind. Tools like trusts, gifting strategies, and tax-advantaged accounts can protect your assets and ensure more of your legacy stays in the family. In short, managing taxes wisely isn’t just about saving money now, it’s a long-term approach to growing and preserving wealth for future generations.

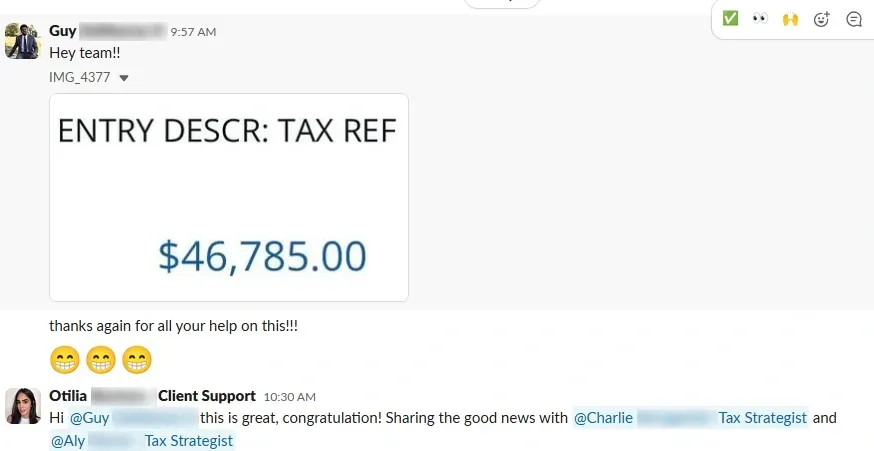

While You're Overpaying, We Are Collecting Refunds

The same strategies available to you right now if you're ready to act.

The Big Beautiful Bill

The Big Beautiful Bill (which officially became law on July 4, 2025) is one of the most significant pieces of tax legislation in American history. This law has dramatically changed the Internal Revenue Code.

It is absolutely crucial for anyone who wants to optimize their tax strategy to fully understand how to leverage all of the tax changes included in the Big Beautiful Bill. This bill has changed the tax brackets, the bonus depreciation rules, the state and local tax (SALT) caps, the child tax credit (CTC), taxes on tips, taxes on overtime, and so much more.

It is likely that the tax changes in the Big Beautiful Bill will remain the law of the land for many years to come. In the Tax Free Millionaire Summit, I will teach you key strategies you can use to leverage the most important changes to the tax code from this bill to the maximum extent.

My Mission

As a tax professional, I am fully aware that there are millions of people across the United States who pay the IRS way more than they have to in taxes every single year. The only thing stopping these people from keeping more of their money is a lack of knowledge of the tax strategies that are available to them.

High earners are hit the hardest because they fall into the highest tax brackets. If you’re a six, seven, or eight-figure earner, you could literally be paying hundreds of thousands or even millions of dollars more in taxes than you have to every single year.

My mission is to teach as many people as possible to save as much money as possible by using the tax code as it was intended to be used. People benefit tremendously by keeping more of their income. I want to give people their power back.

See How Others Are Unlocking IRS-Approved Loopholes

These business owners discovered what the tax code actually allows, legally and ethically.

Picture This

You complete the 3-day Tax Free Millionaire Summit.

You then implement some of the strategies you learned in the summit.

You save hundreds of thousands of dollars in taxes.

You use that money to grow your business, invest in assets, or upgrade your lifestyle.

The Best Part?

You now have the skills and the resources to repeat this process every year, meaning you will keep on paying little to nothing in taxes every year for the rest of your life.

Why You Don’t Have to Fear the IRS

Sadly, many people hesitate to get started with tax strategy simply because they are too afraid of the IRS and they are concerned about being audited.

But here’s the thing. The IRS is well aware of all of the tax strategies out there that millionaires and billionaires use on a regular basis. Using tax strategies that comply with the Internal Revenue Code does not trigger a red flag for an IRS audit.

The IRS is mostly looking to audit people who are breaking the tax rules, not taxpayers who use the tax code intelligently to lower their tax burden.

Remember, the government intentionally included hundreds of different deductions, credits, loopholes, and exemptions into tax law. These opportunities are meant to be taken advantage of. The IRS is perfectly fine with you using them as long as you play by the rules.

All of the tax strategies that I will teach you in the Tax Free Millionaire Summit are grounded in the U.S. tax code and backed by IRS guidance. I will show you how to leverage the tax code to the fullest extent.

By The End Of 3 Days, You Will Have A Step-By-Step Playbook For How To Reduce Your Tax Bill by 50-100%

I Will Completely Change The Way You See Taxes.

WHAT?

Live 3-Day Tax Free Millionaire Summit for high earners who are ready to stop paying a fortune in taxes every year.

WHEN?

October 21-23, 2025

5:00 PM-6:00 PM PST

Q&A: 6:00PM-6:30PM PST

Digital Event

WHY?

Learn how to reduce your total tax bill by 50-100 percent by implementing advanced tax strategies.

Warning: These Testimonials May Make You Fire Your CPA

Because once you see what's possible, basic tax prep will never feel like enough again.

How Life WIll Change After the Tax Free Millionaire Summit

BEFORE

Paying huge tax bills every single year.

Failing to use powerful tax strategies regularly.

Frustrated that your CPA isn’t saving you enough money in taxes.

Confused about why some people are able to pay so little in taxes.

Constantly stressed about upcoming tax bills.

AFTER

Knowing how to cut your tax bill by 50-100%.

Understanding how to implement game-changing tax strategies.

Not relying on a CPA to lower your taxes.

Full clarity about why some wealthy people pay little to no taxes.

Having complete peace about your tax situation.

The Cost of Not Learning Advanced Tax Strategy

The average person who makes $1 million in the U.S. pays somewhere between $300,000 - $400,000 per year in federal and state income taxes.

So, if you make a million dollars per year, and pay $350,000 per year in income taxes, then without implementing advanced tax strategy, you would pay roughly $3.5 million in income taxes over the next ten years. However, if you move forward with tax strategy, you could potentially cut your tax bill by at least 50-80%. This means you could save $175,000 - $280,000 per year, or $1.75 million - $2.8 million over a ten-year period.

If you are a high earner, not implementing advanced tax strategy could literally be costing you millions of dollars per decade.

Part of the reason why many of the wealthiest families in the country continue to remain the wealthiest families for generations is because they understand the importance of strategic tax planning.

For many people, strategic tax planning is one of the greatest investments and best financial moves they ever make, and it can be for you as well. Set your family up for the best possible financial future by joining the Tax Free Millionaire Summit.

Frequently Asked Questions

Get the answers you need.

Need more help? Email us at [email protected] or contact us at (714) 683-0547

1. Is this event in-person or online?

The Tax Free Millionaire Summit is a fully digital event. This means you’ll be able to acquire game-changing tax knowledge without ever having to leave the comfort of your own home!

It’s one of the largest digital tax conferences in the entire world, bringing together cutting-edge strategies, expert insights, and powerful tools all in one place.

This summit is a high-impact, results-driven experience designed to give you actionable strategies you can implement immediately. Whether you're a business owner, investor, or high-income earner, this summit will show you exactly how to reduce your tax bill and build long-term wealth effectively. Each day builds on itself to make the lessons as easy to understand as possible and prevent you from getting overwhelmed.

2. Is it a live event?

Yes, this is a live event! Tax expert Karlton Dennis will be providing game-changing tax training in a live format. If you sign up for VIP, you will also be able to ask questions directly to Karlton for a half hour before each training session starts.

The live training sessions will be recorded. However, you will only be able to see the recording during the duration of the summit. Lifetime access to the recordings is available to people who buy a VIP ticket or upgrade to one during the summit. Having lifetime access to the training session recordings can be extremely beneficial for helping you retain all of the information from the summit on a long-term basis.

3. What is Tax Alchemy?

Tax Alchemy is one of the fastest-growing tax strategy firms in the U.S. Karlton Dennis is the Founder and CEO of Tax Alchemy. We specialize in helping high earners implement powerful tax strategies that can lower their tax bills by a substantial amount. Once clients are onboarded, we work with them throughout the year to implement a wide variety of advanced tax strategies. Here at Tax Alchemy, we leverage over 160 tax strategies!

Our mission is simple: help entrepreneurs, investors, and professionals keep more of what they earn legally and efficiently. With a proven track record of generating 6 or 7-figure tax savings for our clients, Tax Alchemy is the go-to firm for serious wealth builders ready to play the tax game at the highest level.

4. What if My CPA Has Already Told Me I Maxed Out My Tax Deductions?

CPAs often avoid discussing advanced tax strategies with their clients because it makes their jobs easier not to do so. So, just because your CPA says there is nothing else you can do to lower your taxes does NOT mean that it is true. If your CPA has told you this, then this summit is definitely for you.

The truth is, most CPAs focus on compliance, not strategy. That’s where the Tax Free Millionaire Summit comes in. We’re pulling back the curtain on the tax-saving methods your CPA won’t talk about. This event will empower you with insider knowledge to take control of your financial future and start playing offense with your taxes, not just defense.

5. Will I Be More Likely to Get Audited if I Use These Tax Strategies?

No, the government specifically includes tax credits, exemptions, and deductions in the tax code so that people will use them. Therefore, using any of these strategies is not a red flag for the IRS.

In fact, the wealthy and well-advised have been using these exact strategies for decades. It’s how they legally reduce their tax bills while growing their wealth faster. The real problem isn’t using the strategies, it’s not knowing they exist. That’s why the Tax Free Millionaire Summit is so powerful; it gives you access to the same tax playbook the top 1% use, so you can stop overpaying and start optimizing.

6. Should I Attend this Event if I am Not A Business Owner and Have a W-2 Job?

If you are making $400k+ as a W-2 earner, then yes, this event is for you too. It is not just limited to business owners, investors, and independent contractors.

High-income earners with W-2 income are often the most overtaxed group and the least informed about the legal strategies available to them. The Tax Free Millionaire Summit will show you exactly how to take advantage of real estate, entity structuring, and income-shifting strategies that can dramatically lower your tax bill, even without owning a business. If you're serious about keeping more of what you earn, this event is your blueprint.

7. Can I Bring My Spouse?

Yes! In fact, we highly encourage you to bring your spouse to the Tax Free Millionaire Summit. Not only does having your spouse learn tax strategy make you a more powerful tax-saving team, but we will also be covering some strategies that specifically apply to married couples.

When both partners understand the tax game, it’s easier to align your financial goals, implement advanced strategies, and maximize your household’s savings potential. From income shifting to family payroll optimization, these strategies can work even better when both of you are on the same page.

8. How many people has Tax Alchemy already helped to save substantial money in taxes?

We’ve helped over 3,000 clients collectively save hundreds of millions of dollars in taxes, and that number keeps growing every single month! From business owners and real estate investors to high-income W-2 earners, our clients are proof that the right tax strategies can create massive, life-changing results.

We only leverage IRS-approved strategies that the wealthy have been using for decades. At Tax Alchemy, we bring those same strategies to people who are serious about keeping more of what they earn and building real, lasting wealth. If you're tired of overpaying and ready to play the tax game at a higher level, you're in the right place.

9. How Much Does This Summit Cost?

General Admission (Early Bird) is just $47! VIP is $197. Both ticket tiers will offer you a front-row seat to the greatest digital tax strategy training in the world. Over the course of 3 days, you will learn the top tax strategies used by the wealthiest Americans to save a fortune in taxes. These are the secret strategies that most people don’t understand or have never heard of.

If you sign up for VIP, you will get a variety of additional benefits including lifetime access to the recordings, access to our proprietary tax strategy opportunity finder, and access to our exclusive workbook and Zoom background. So, you get hundreds of dollars’ worth of additional value with the VIP ticket. We highly recommend that you go with the VIP ticket to get the most value possible from the summit.

10. What if I Want to Skip the Summit and Start Working Directly with Tax Alchemy?

Some taxpayers are ready to start working with Tax Alchemy right away and want to skip the summit. If that is you, terrific! We are excited to speak with you and explain how we can implement high-powered tax strategies on your behalf.

If you would like to start working with Tax Alchemy immediately, then you can fill out your application here. Once you fill out your application, and if you are a good fit for our services, you will be able to book a call to speak with a Tax Alchemy Advisor. Your Advisor will answer all of your questions and explain the next steps to you.

11. What Happens if I Miss a Day of the Summit?

The 3-day Tax Free Millionaire Summit is a recorded event. However, the recordings will only be available during the summit. This means you will be able to watch the recordings on the days that the event takes place, but not after the event concludes.

If you would like to have lifetime access to the recordings, you can upgrade to a VIP ticket. If you do end up going with the option that gives you lifetime access, you will be able to return to the recordings time and time again to reinforce all of the education you gained during the summit.

Terms of Service | Refund Policy | Contact Us

© Copyright 2025 | All Rights Reserved